SUMMARY

WEEKLY POLL

→ Last week’s poll

Which describes your opinion of the Trump administration thus far?

35% - Mixed feelings ✅

25% - Pretty good

25% - Yikes

15% - Fantastic

→ This week’s poll

Reminder: Neither I nor anyone else can see how you vote.

SUBSTACK READS

→ The Parallel Economy and the New Rules of American Power

A construction contractor I met in Northern Kentucky a few weeks ago put it bluntly: "I'm supposed to be bidding on projects that will finish in 2028, but I have no idea what materials will cost next month, let alone next year. I can’t see straight." Behind the abstract economic statistics are real people making real decisions with increasingly little information to go on.

Being Contrarian About Everything Is Intellectually Bankrupt

The impression I get is that the Trump administration sees all professors and experts of the world as useless dullards, good for nothing but mockery. And sure, academia has plenty of flaws, but rejecting expert consensus just because it’s consensus is no better than the worst excesses of wokeness.

The Democrats’ Brahmin Left Problem

In short, Democrats need a class traitor—a politician who’s not afraid to ask Democrats who the social justice they prize so highly is really for. Is it really for the poor and working class who have the short end of the stick in our society or is it to make Democrats feel righteous and onside with Team Progressive? Are Democrats’ social justice commitments and priorities what the poor and working class actually want? Does the language Democrats speak on these issues even make sense to them?

FOOD FOR THOUGHT

→ Economic sentiment is rolling over

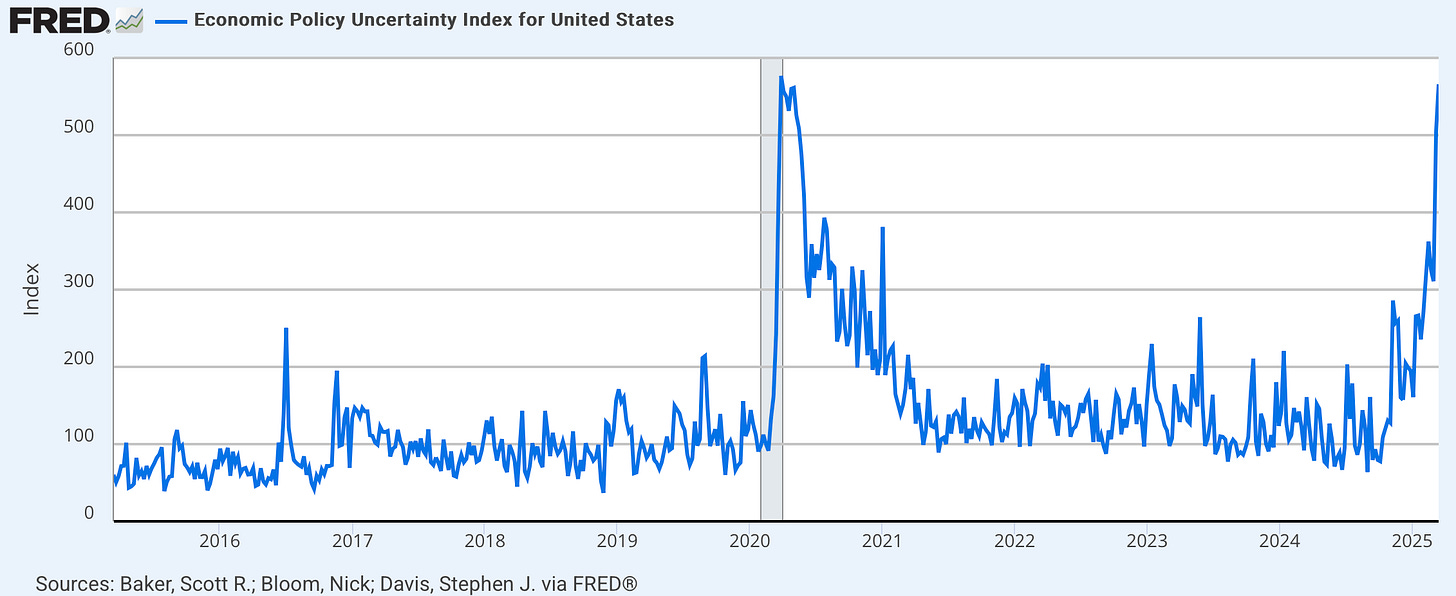

Trump’s on-again, off-again tariff policy has caused economic uncertainty to spike to levels not seen since 2020:

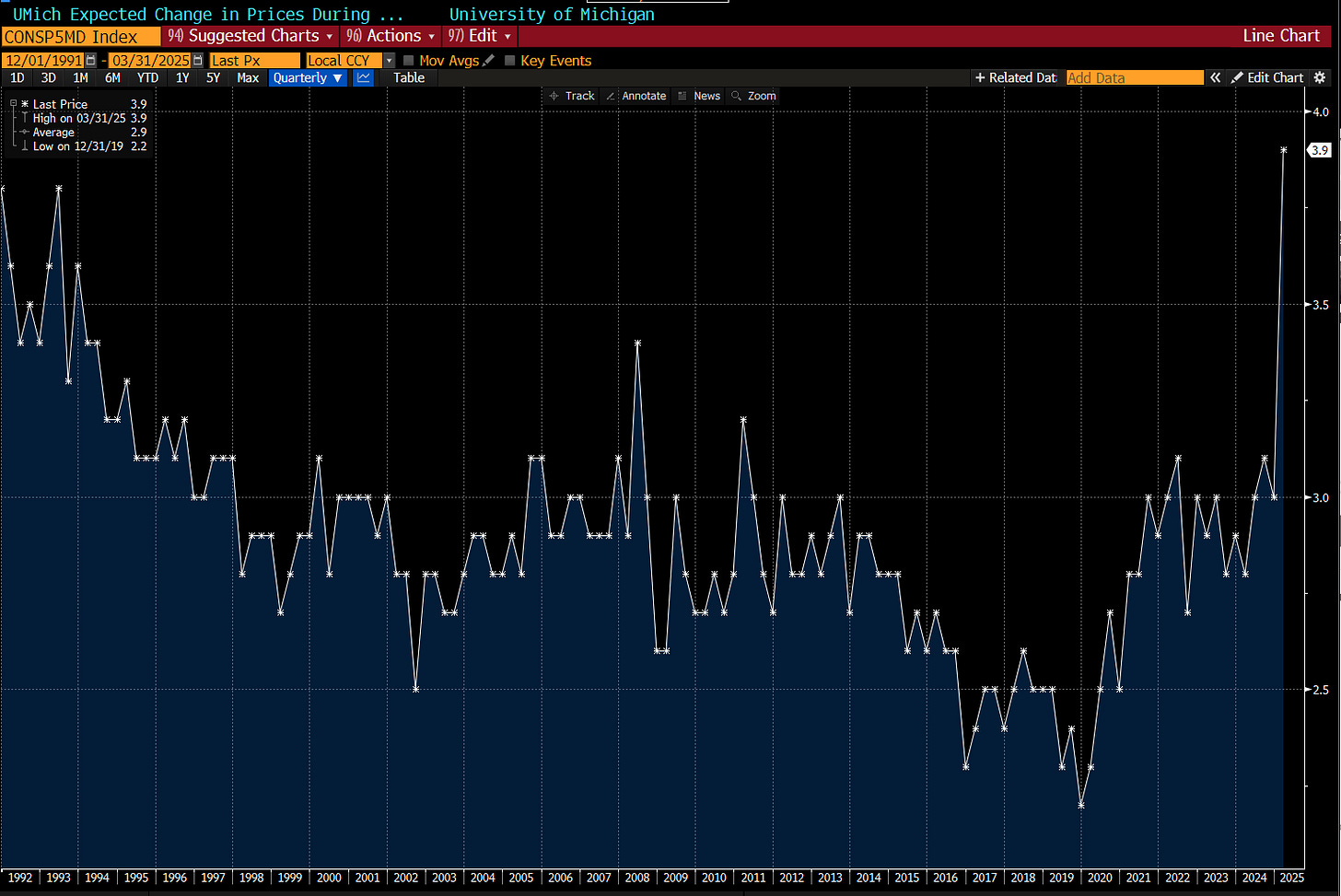

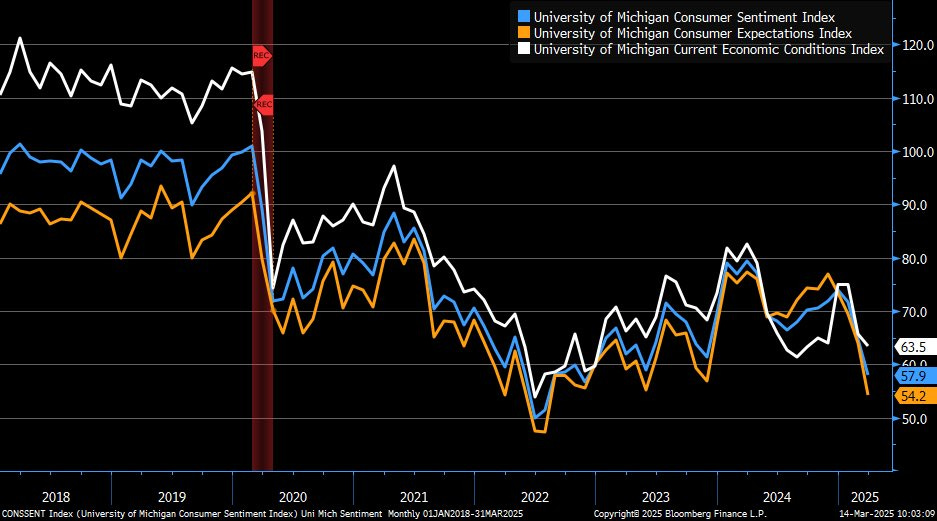

UMich survey data released on Friday painted an increasingly stagflationary picture, with inflation expectations on the rise and consumer sentiment falling:

What doesn’t quite square up with the spike in inflation expectations, interestingly, is consumers’ labor market expectations — expected change in unemployment is the worst since 2008 (no one is asking for a raise in this environment):

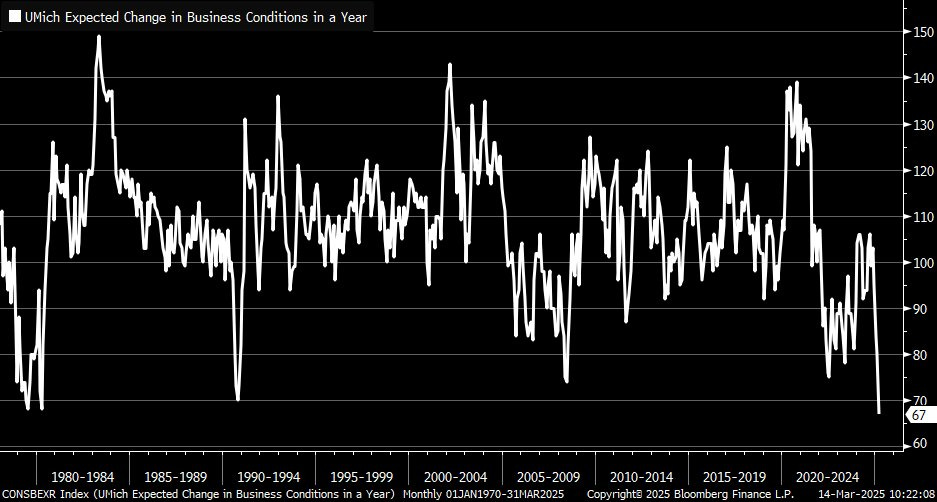

Additionally, in the history of the UMich survey, consumers have never been this pessimistic when it comes to expectations for business conditions in the coming year:

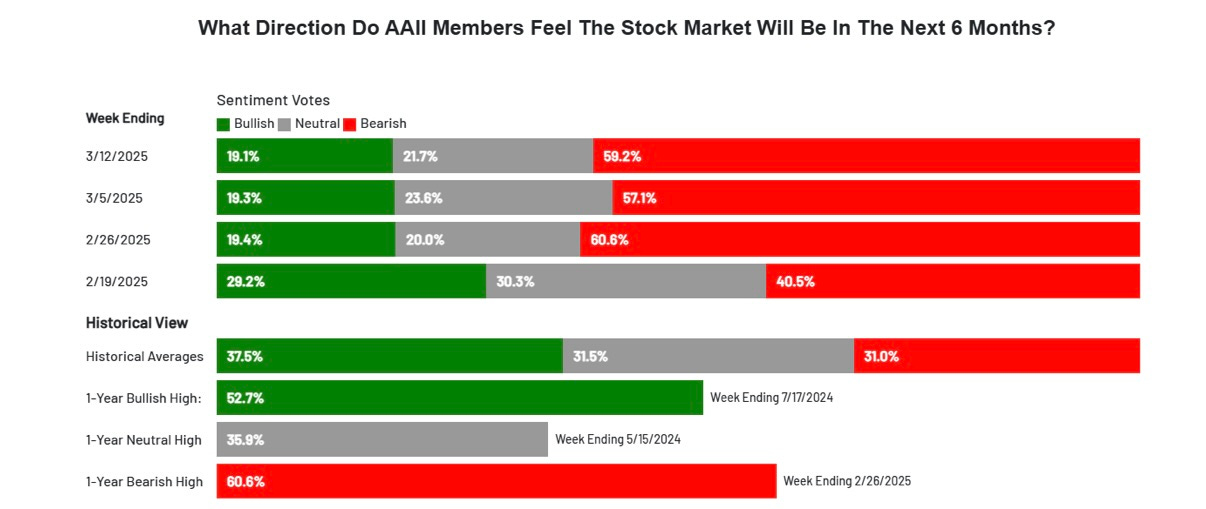

Perhaps unsurprisingly, investor sentiment has also turned quite bearish since February:

When consumers, businesses, and investors suddenly face heightened economic uncertainty, they naturally become cautious — delaying spending, postponing investments, and scaling back hiring.

This collective pullback in confidence reduces demand, stalls growth, and can ultimately cause economic conditions to deteriorate even without an initial shock to underlying fundamentals. (This environment is not conducive to raising prices.)

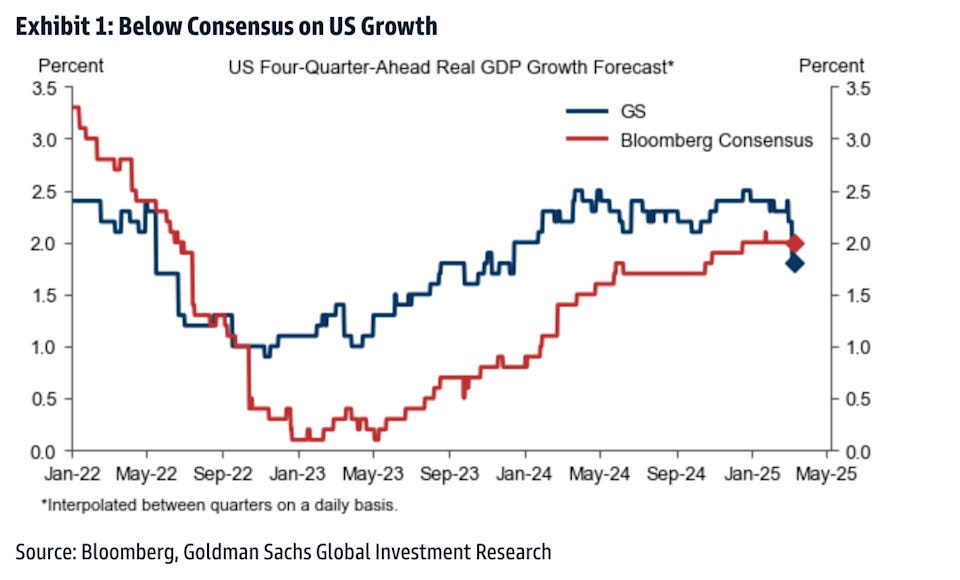

Accordingly, we’re seeing a wave of downward revisions in economic growth forecasts. Goldman Sachs slashed its 2025 GDP forecast to 1.7% from 2.4% on Monday, noting that its trade policy assumptions have become “considerably more adverse”:

Other Wall Street economists and strategists will likely follow suit in revising their forecasts lower. On Friday, JP Morgan lowered its 2025 GDP forecast from 1.9% to 1.6%, citing 3 key risks:

Policy uncertainty

New US tariffs raising prices, slowing spending

Foreign retaliatory tariffs hurting exports

What I think JP Morgan has wrong is that the current environment should actually be disinflationary, whereby potential price increases due to tariffs (higher input costs for businesses passed on to consumers) are more than offset by deteriorating economic conditions (lower consumer demand, anemic wage growth).

And indeed, demand is showing signs of faltering. On the consumer front, a growing list of retailers (including Walmart) are warning that consumers are struggling to afford some essentials, with Dollar General CEO noting in a recent earnings call that “trade down is back.”1

Although the GDP impact of tariffs alone is highly unlikely to cause a recession, the second order effects — broad uncertainty and falling sentiment — pose real risks to the US economy.

→ What to watch for in markets

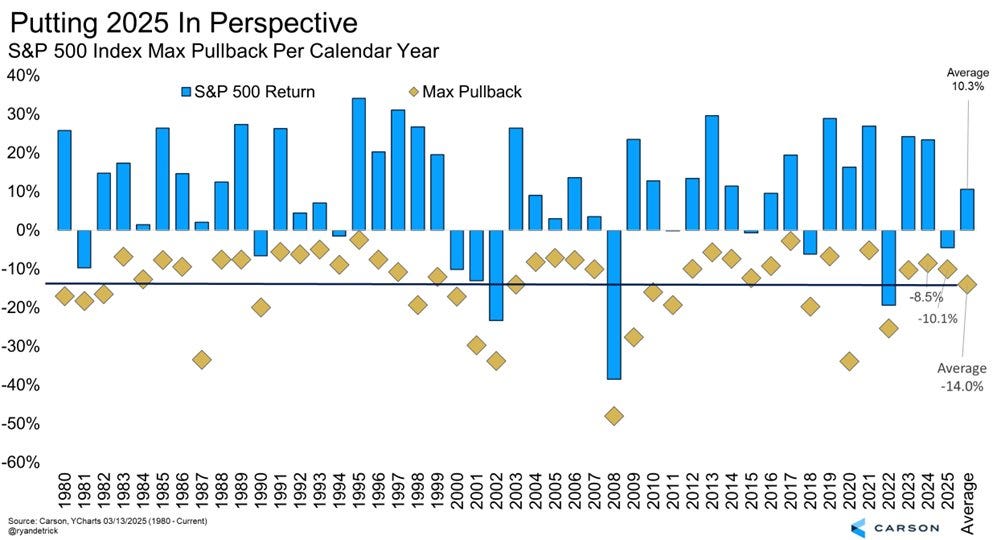

Amid the mounting economic uncertainty, markets went into risk-off mode with the S&P 500 briefly slipping into a correction (defined as a decline of over 10%) on Thursday, though bouncing off the lows into the weekend:

From the February highs, the S&P has pulled back by more than 8% as of Friday’s close. To put this in perspective, the S&P’s average maximum decline per calendar year is 14%:

Indeed, corrections in the stock market are normal and, given how richly valued stocks were and still are (S&P P/E ratio is still above 20x versus its historical ~18x average) perhaps healthy.

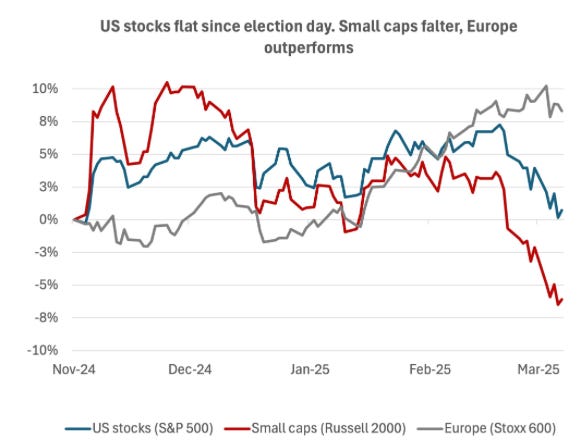

The recent pullback has been underpinned by a few key themes. First, small cap stocks have suffered the most while Europe has outperformed the US:

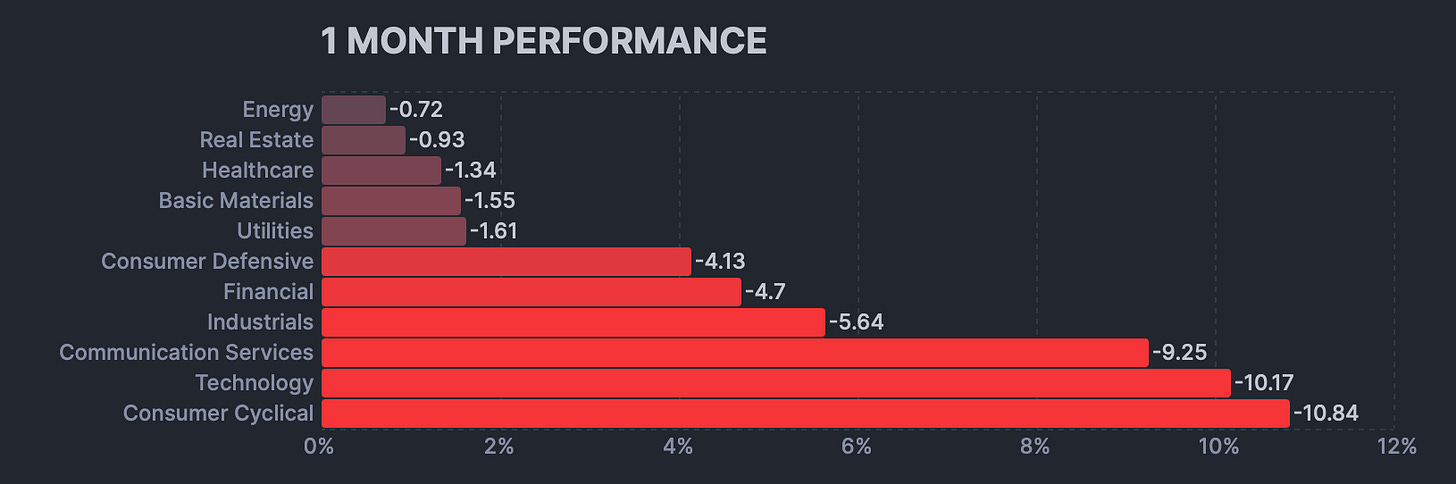

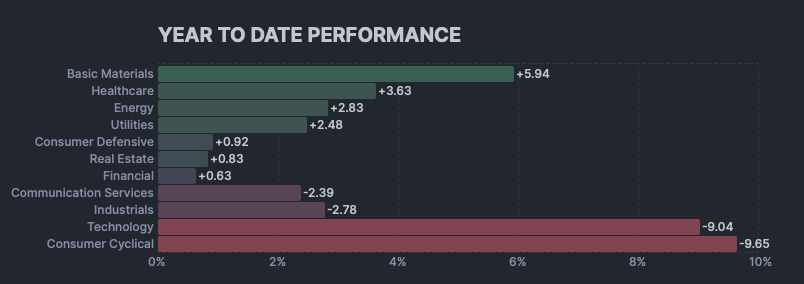

Second, within the US, we’re seeing a bifurcation in the market signaling a classic growth scare as investors rotate out of growth (i.e., tech and consumer cyclical) in favor of more value-oriented safe-havens like healthcare, utilities, and consumer staples:

Finally, spreads between high-yield bonds and Treasuries — or “credit spreads”, a leading economic indicator signaling financial risk aversion — are the widest they’ve been since August 2024:

Though still very narrow by historical standards, the recent trajectory in credit spreads is drawing increased attention.

As we look ahead, it’ll be critical to monitor three key market dynamics: U.S. versus international stock performance, sector rotation, and credit market conditions.

The stock market will likely bottom only once credit spreads stabilize and growth stocks begin to outperform value stocks again.

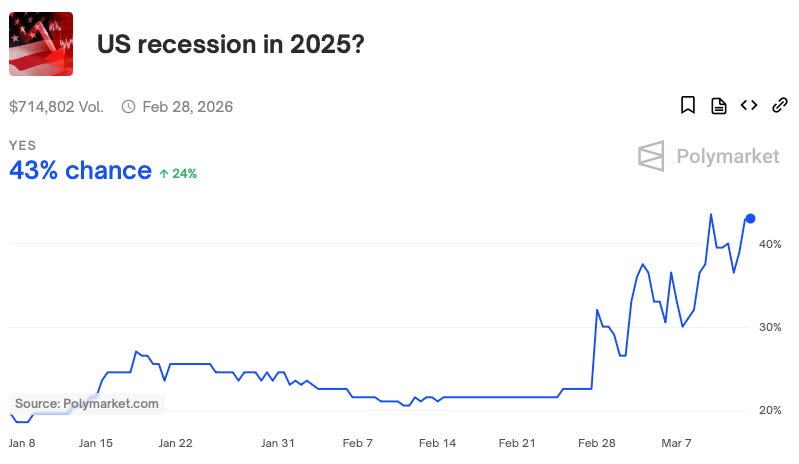

PREDICTION MARKETS

→ Recession odds

The R-word is back. Prediction market odds of a US recession in 2025 continue climbing to near 50/50. (Two consecutive quarters of negative Real GDP growth constitutes a recession.)

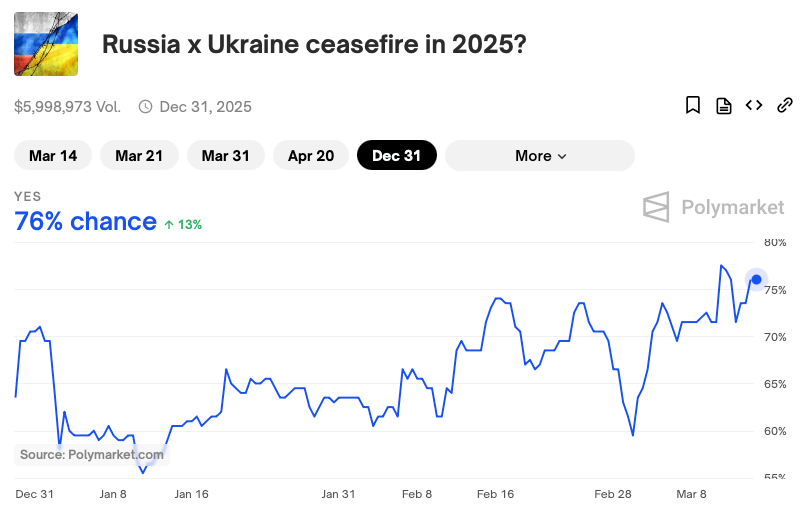

→ Russia x Ukraine ceasefire

US-brokered talks in Saudi Arabia secured Ukraine’s nod to a 30-day truce, with Trump pressing both sides. Putin has been receptive but insists on locking in territorial gains and NATO limits. A Russia-Ukraine ceasefire in 2025 is looking increasingly plausible to prediction markets bettors:

In retail, "trading down" means consumers are choosing less expensive alternatives or lower-priced items compared to their usual purchases, often due to economic factors like rising prices or budget constraints.

"What doesn’t quite square up with the spike in inflation expectations, interestingly, is consumers’ labor market expectations"

I think the uncertainty is the answer. If X is happening you may think Y will result and if Z is happening P will result whether tail risk of both distributions change the central tendency can change in ways that down not accord with either X believers' or Y believers' model.

Another way of saying this is the people are fearing" stagflation."

My biggest economic fear would be Trump tariffs.

1) Although tariffs alone probably won't cause a recession, the tariffs are being imposed in an economy weak enough to prevent the incumbent president's party from winning.

2) DOGE is cutting government spending, removing dollars from the economy.

3) Tariffs are a regressive tax that disproportionally hurt the working class, which means consumer spending (70% of GDP) will rely more on the rich.

4) The top 10% account for half of all spending (https://www.wsj.com/economy/consumers/us-economy-strength-rich-spending-2c34a571), but the S&P is down 4% YTD, which directly reduces the spending power of the rich.